- The Price You Set Can Make (or Break) Your Sale

There’s one decision you're going to make when you sell that determines whether your house sells quickly, or it sits.

- The Real Reason Home Sales Slowed in January. And It’s Not What You Think.

If you saw headlines that talked about how “home sales fell sharply in January,” it probably raised an eyebrow – especially if you’re thinking about selling your house. But context matters.

- Move-Up Buyers Are Choosing New Construction

At some point, a house that once felt perfect just… doesn’t anymore.

- Four Ways Your Home Equity Can Work for You

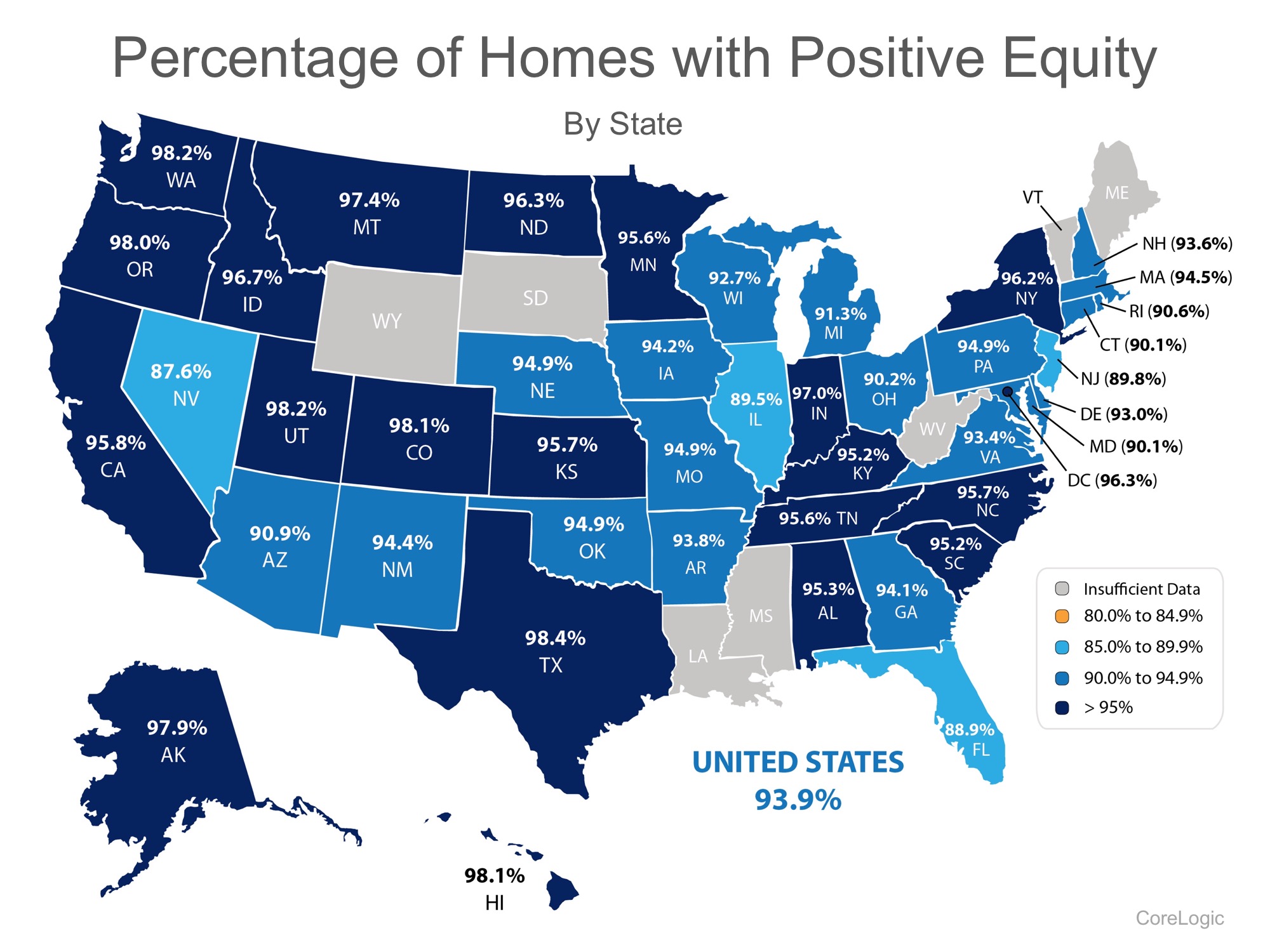

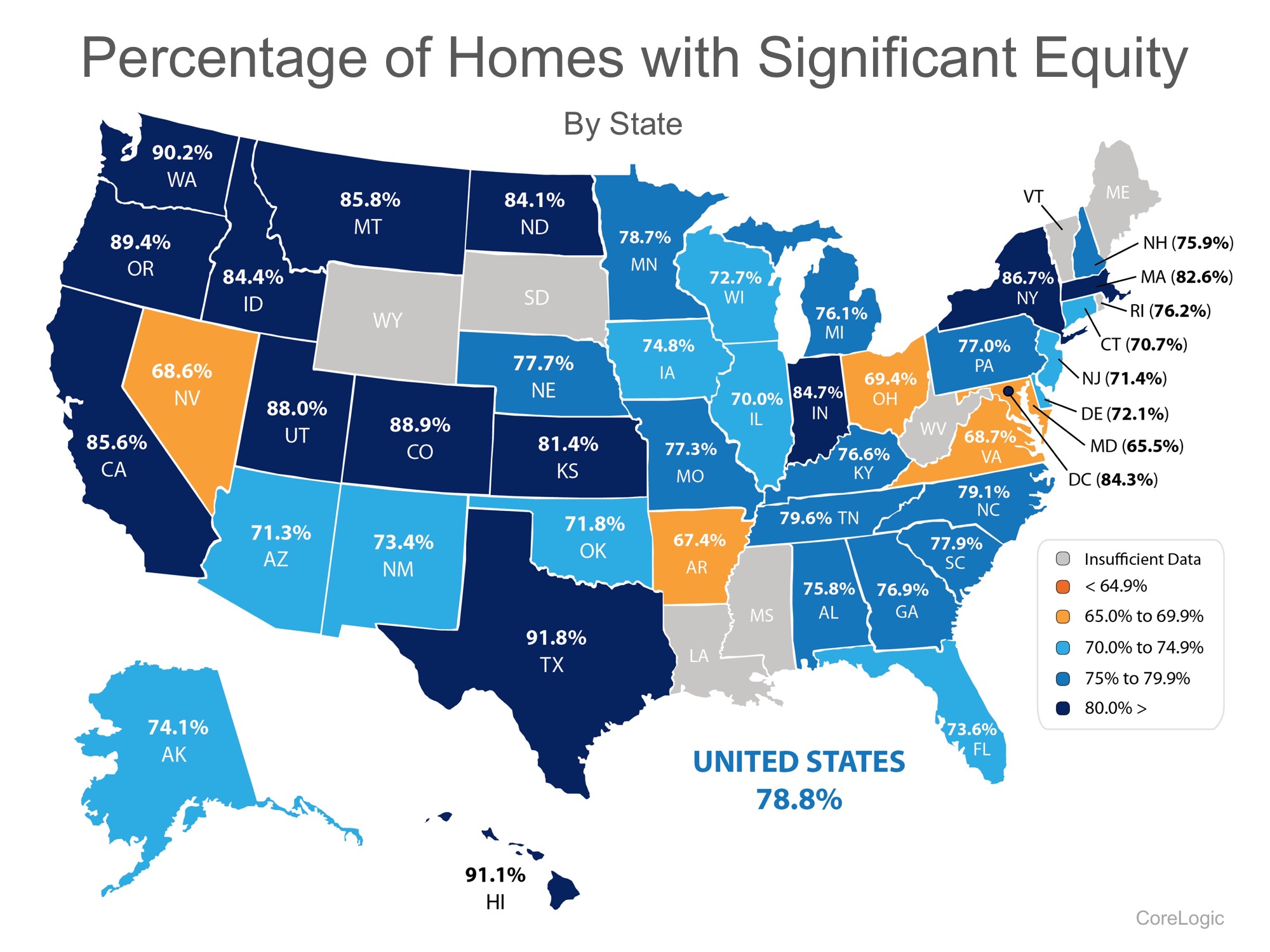

You may have heard homeowners today have a lot of equity built up. But what does that really mean? Let’s break it down.

- Inventory Is Making a Comeback in 2026

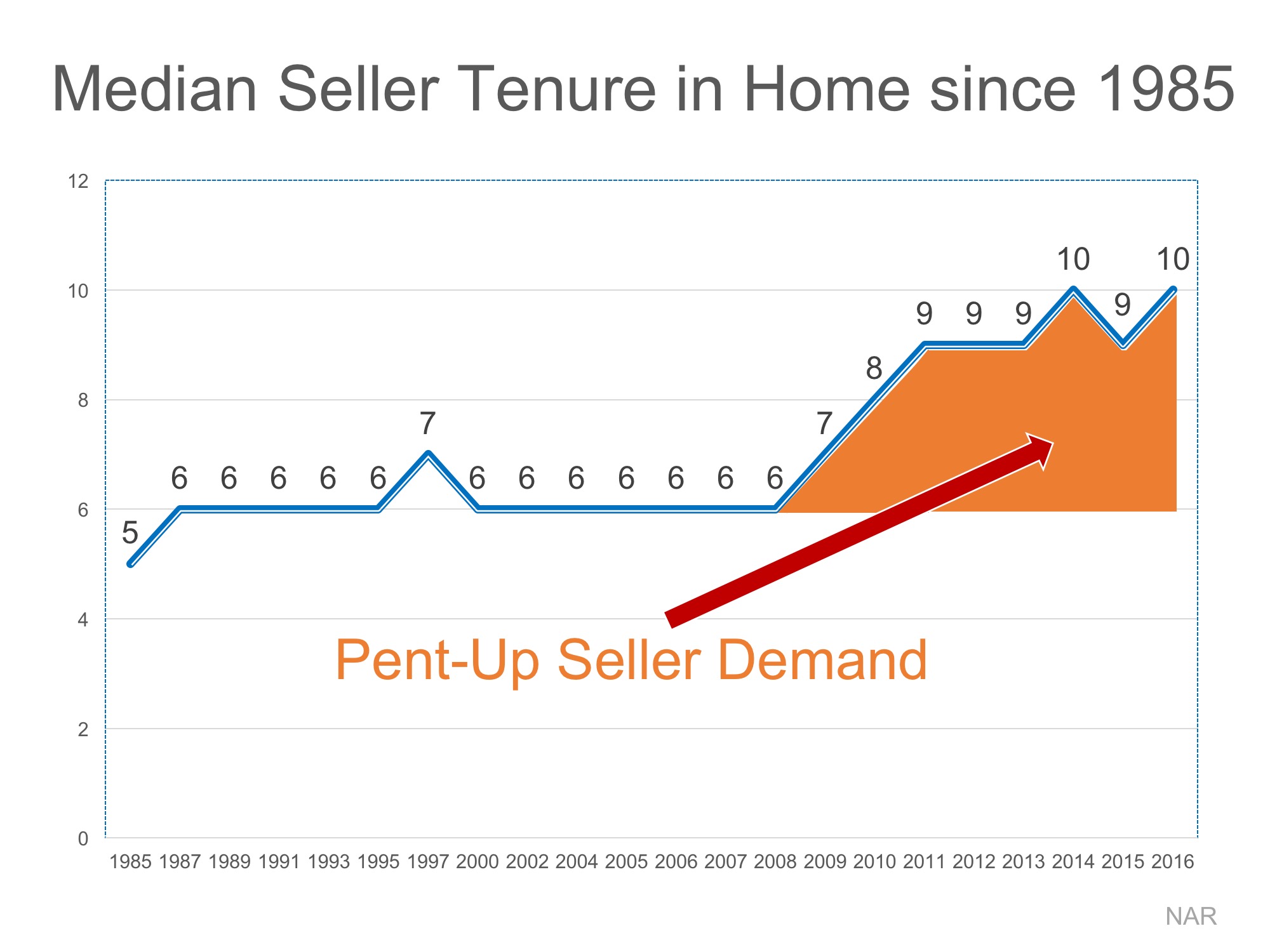

After a long stretch where buyers were competing for too few homes, inventory has made a comeback over the past year.

- Why Townhomes Are Popular with Today’s First-Time Buyers

Buying your first home can feel frustrating when the numbers don’t line up the way you expected.

- Top 3 Reasons To Buy a Home Before Spring

If you’re planning to buy a home this year, you may be focused on the spring market.

- It’s Getting More Affordable To Buy a Home

There’s finally a little good news for anyone who’s been priced out or sitting on the sidelines.

- Home Insurance Costs Are Rising: What Buyers Should Plan For

Buying a home is one of the biggest purchases you’ll ever make. And homeowner’s insurance is what protects that investment.

- Why So Many Homeowners Are Downsizing Right Now

For a growing number of homeowners, retirement isn’t some distant idea anymore. It’s starting to feel very real.

Homeowner’s Net Worth Is Still Greater Than a Renter’s

Every three years, the Federal Reserve conducts their Survey of Consumer Finances in which they collect data across all economic and social groups. The latest survey, which includes data from 2010-2013, reports that a homeowner’s net worth is 36 times greater than that of a renter ($194,500 vs. $5,400).

The latest survey data, covering 2014-2016 will be released later this year. In the meantime, Lawrence Yun, the National Association of Realtors’ Chief Economist estimates that the gap has widened even further, to 45 times greater ($225,000 vs. $5,000)!

Put Your Housing Cost to Work for You

As we’ve said before, simply put, homeownership is a form of ‘forced savings.’ Every time you pay your mortgage, you are contributing to your net worth. Every time you pay your rent, you are contributing to your landlord’s net worth.

The latest National Housing Pulse Survey from NAR reveals that 84% of consumers believe that purchasing a home is a good financial decision. William E. Brown comments:

“Despite the growing concern over affordable housing, this survey makes it clear that a strong majority still believe in homeownership and aspire to own a home of their own. Building equity, wanting a stable and safe environment, and having the freedom to choose their neighborhood remain the top reasons to own a home.”

Bottom Line

If you are interested in finding out if you could put your housing cost to work for you by purchasing a home, let’s get together and evaluate your ability to buy today!

Powered by WPeMatico

![What State Gives You the Most ‘Bang for Your Buck’? [INFOGRAPHIC] | Simplifying The Market](http://d39ah2zlibpm3g.cloudfront.net/wp-content/uploads/2017/08/04155449/STM-Share.jpg)

![What State Gives You the Most ‘Bang for Your Buck’? [INFOGRAPHIC] | Simplifying The Market](http://d39ah2zlibpm3g.cloudfront.net/wp-content/uploads/2017/08/04155326/20170811-100-Gets-You-STM.jpg)

![20 Tips for Preparing Your House for Sale [INFOGRAPHIC] | Simplifying The Market](http://d39ah2zlibpm3g.cloudfront.net/wp-content/uploads/2017/07/17162328/20170804-Share-STM.jpg)

![20 Tips for Preparing Your House for Sale [INFOGRAPHIC] | Simplifying The Market](http://d39ah2zlibpm3g.cloudfront.net/wp-content/uploads/2017/07/17162255/20170804-Tips-For-Selling-STM.jpg)